On May 19, 2023 I asked questions about rolling back property taxes to 2020 levels for all properties, and removing the link with CPI, which may actually be contributing to inflation. In particular the rent freeze coupled with rising property taxes has had a negative impact on affordable housing, as landlords are losing money and are leaving the rental business.

Speaker: The hon. Member from Rustico-Emerald.

Mr. Trivers: Thank you, Madam Speaker.

We live in an inflationary environment and costs across the board have increased significantly over the last few years. It doesn’t matter whether you’re a homeowner, a tenant, or a landlord, those costs have gone up.

The Premier decided to ignore the carefully calculated IRAC recommendations and completely eliminated any allowable rent increases this year. Not even a small increase was allowed, even though most tenants can afford a small increase. We even heard that directly from tenants in the news recently. And government has a plethora of programs to help tenants –

An Hon. Member: A plethora.

Mr. Trivers: – who can’t afford their rent. Instead, the decision was made to freeze rents and provide a relief program to landlords. Okay.

So, for example, a 2023 rental unit property tax subsidy was implemented; however, landlords are telling me this subsidy is woefully inadequate, working out to approximately 2 percent in most cases. Only 2 percent, when property taxes themselves have gone up, in most cases, well over 10 percent in the last couple of years.

So, it’s no wonder that we are seeing a decrease in affordable rental housing on PEI, as many landlords, especially longtime landlords, looking to –

Speaker: Hon. member, do you have a question?

Mr. Trivers: Yes – locked into low rents (Indistinct) are sustaining ongoing losses with no ability to stop them and are simply getting out of the rental housing business.

Freezing property taxes for rentals

Question to the Premier: Will you roll back and freeze property taxes for rental properties to at least 2020 levels in an effort to stop the elimination of affordable rental housing?

Speaker: The hon. Premier.

Premier King: Madam Speaker, first of all, we implemented a pause on a 10 percent rent increase at a time when 17 or 18,000 Islanders were being impacted with rising costs of food, fuel, and everything else. It was something that we needed to do.

We’ve tried very hard to implement programs that can assist those landlords, which are important in the big scheme of things. No government program we would ever put through would be perfect, and it was never designed to make everybody “whole”. Until we implemented the act, we wanted to make sure that there was a level playing field for those and they didn’t need to be unfairly impacted.

The rent increase, across the board, as I’ve said many times in here, we realize that there are individuals who had been heating their apartments with oil, et cetera, that would need to increase the rent, but we didn’t also see a need to increase rent for new properties that are already at a high level of rent when they hadn’t seen increases in electricity or anything else that they needed. So, we tried to find the threshold, and I’m very proud that we stood here and we stopped a 10 percent increase in rent. I’ll never regret doing it, Madam Speaker.

Some Hon. Members: Hear, hear!

Speaker: The hon. Member from Rustico-Emerald, your first supplementary.

Mr. Trivers: Madam Speaker, affordable housing is what is being reduced and is taking the brunt of these policies.

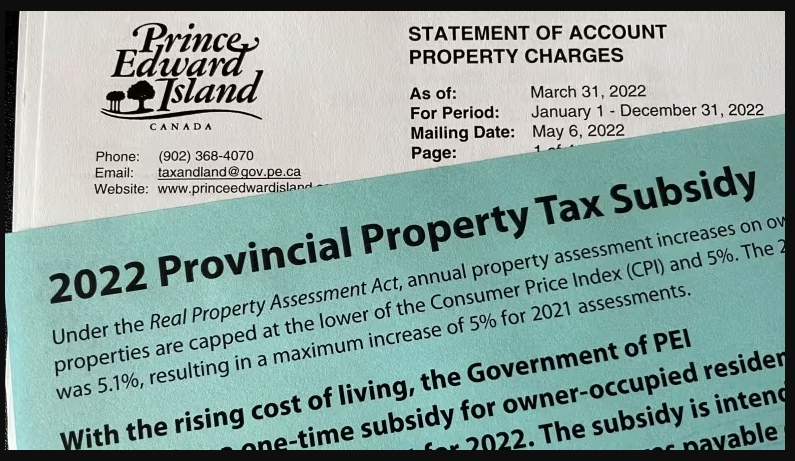

On the other hand, the Premier decided to do something different for owner-occupied properties, and they introduced a property tax subsidy that eliminates owner-occupied taxes – an increase, at least – by providing a subsidy to match; essentially freezing taxes, at least in the short term, for the last couple of years this has happened.

In fact, this subsidy is especially frustrating to small landlords because the Real Property Assessment Act defines an owner-occupied residential property as one where a property owner “…did not lease or rent any part of the residential property.” This means homeowners trying to make ends meet by doing things like renting out their basement, at the same time providing much-needed affordable rental housing, don’t even qualify for the property tax subsidy for owner-occupied properties.

Differences in property tax freezes

A question to the Premier: If you really want to provide relief to landlords, especially small landlords, why didn’t you freeze rental property taxes the same way you did for owner-occupied property taxes?

Speaker: The hon. Premier.

Premier King: Madam Speaker, that is a good question.

I guess it really would require us to determine who would actually need to see that increase. It’s hard, as I’ve said in here many times – and I know Hannah Bell is not here anymore, and she would always criticize me for saying it – but it’s hard to implement a government policy for a hundred people or for 10 people. When you implement policy, you try to find the level.

I realize there are individual landlords that are impacted, but I also realize there are a lot of landlords who wouldn’t need to see their property taxes frozen.

All of that to say I’ll continue to look and explore good ideas of how we can help. All of these individuals play a role in the housing continuum, Madam Speaker, but at the same time, we have to remember that 17 or 18,000 Islanders who rent didn’t need to see a 10 percent increase, and that’s why we halted it.

Speaker: The hon. Member from Rustico-Emerald.

Mr. Trivers: Madam Speaker, the Real Property Assessment Act ties property assessment to the All-Items Consumer Price Index, the CPI, which increases with inflation. In fact, many economists believe a policy to have property taxes tied to CPI actually drives inflation. They’re saying it’s a bad policy.

Some people consider it a tax grab that increases taxes right at the same time that Islanders need help the most to lower the cost of living. At the same time, the thresholds for programs to support people who can’t afford housing aren’t linked to CPI. I know that firsthand, that even as a minister, it’s a real battle to get those thresholds increased.

Separating property taxes from CPI

To the Minister of Finance: I think we’ve got a fresh perspective over here. I hope we do. Will you change the Real Property Assessment Act to remove this inflation-driving tax grab that ties property taxes to CPI?

Speaker: The hon. Minister of Finance.

Ms. Burridge: Thank you, Madam Speaker.

I am familiar, somewhat, on this, and I appreciate what you’re bringing forward. I think, at the end of the day, what we all want is appropriate and attainable housing for all Islanders. That’s probably our goal in all of this.

What I can tell you, hon. member, is I will take what you’ve given here today, and I will bring it back and bring it to the team and see what we can come up with.